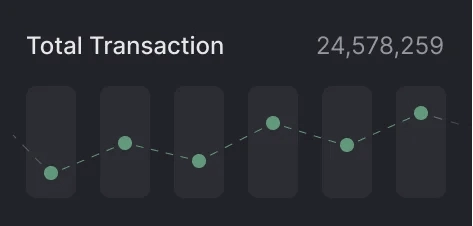

Let’s navigate the Commodities Trading together

Commodities Trading with Seamless Markets

A commodity, also called a primary product or primary commodity, is a good that is sold for production or consumption exactly as it is found in nature. Commodities include crude oil, coal, copper or iron ore, rough diamonds, and agricultural products such as wheat, coffee beans or cotton; They are often traded on commodity exchanges.

What are Commodities Trading?

Commodities trading stands as a strategic approach to navigating the intricate dynamics of global markets, offering investors and traders a unique avenue for potential profits and risk management. This comprehensive overview delves deeper into the various aspects that make commodities trading a compelling and multifaceted endeavor.

Commodities trading is a dynamic and diverse market offering opportunities for traders and investors. Whether seeking portfolio diversification or capitalizing on short-term price movements, understanding the nuances of commodities trading is crucial for success. Engaging in thorough research, staying informed about market trends, and employing risk management strategies are essential practices for navigating the complexities of commodities markets.

Understanding the Types of Commodities

Agricultural Commodities

These encompass crops and livestock. Trading in agricultural commodities involves factors such as weather conditions, crop yield projections, and global demand for food products.

Energy Commodities

The energy sector involves trading in resources like crude oil, natural gas, and heating oil. Prices are influenced by geopolitical events, supply disruptions, and global energy consumption trends.

Metals

Precious metals like gold and silver serve both as commodities and safe-haven assets. Industrial metals such as copper are closely tied to economic activities and infrastructure development.

Soft Commodities

This category includes commodities like coffee, cocoa, sugar, and cotton. Factors such as climate conditions, disease outbreaks, and global consumption patterns impact soft commodity prices.

Why Trade Commodities with Seamless Markets? Unleash Your Trading Potential

Index trading, a popular form of financial market participation, offers traders and investors a range of advantages, making it a compelling option for those seeking diversified exposure and strategic portfolio management.

Diverse Range of Commodities

At Seamless Markets, we provide access to a diverse range of commodities, including agricultural products like wheat and soybeans, as well as energy commodities such as crude oil and natural gas. Explore opportunities in these markets and diversify your trading portfolio.

Getting Started with Commodities Trading

Ready to explore the world of commodities trading? Follow these steps to begin your journey with Seamless Markets:

Open an Account

Choose the account type that suits your trading style and open an account with Seamless Markets.

Deposit Funds

Fund your account using our secure and convenient funding options

Choose Your Platform

Select the trading platform that aligns with your preferences.

Start Trading

Dive into the world of indices trading, analyze market trends, and execute your trades with confidence.

Commodities Explained

Commodities trading involves the buying and selling of physical goods or raw materials, creating a dynamic market where traders can speculate on price movements. This market comprises various categories: agricultural products, energy resources, metals, and soft commodities. At Seamless Markets, we provide a platform for traders to engage in commodities trading, offering a range of instruments and resources to enhance their trading experience.

Types of Commodities

These include products like wheat, corn, soybeans, and coffee. Agricultural commodities are influenced by factors such as weather conditions, crop yields, and global demand.

Crude oil, natural gas, and heating oil fall into this category. Energy commodity prices are impacted by geopolitical events, supply and demand dynamics, and global economic conditions.

Precious metals like gold, silver, platinum, and industrial metals such as copper are traded commodities. Metal prices are often influenced by industrial demand, economic trends, and geopolitical stability.

Soft commodities include goods like cotton, sugar, and cocoa. Prices for soft commodities can be affected by factors such as weather conditions, disease outbreaks, and global supply chain disruptions.

Frequently Asked. Questions

Yes, traders can use leverage to amplify their exposure in commodities markets. However, leveraging involves increased risk, and traders should exercise caution and implement risk management strategies.

Common trading instruments for commodities include:

- Spot Contracts: Immediate buying or selling of commodities for cash settlement.

- Futures Contracts: Commitment to buy or sell commodities at a predetermined future date and price.

- Options Contracts: Provide the right, but not the obligation, to buy or sell commodities at a specific price within a set timeframe.

Risk mitigation in commodities trading involves:

- Diversification: Spread investments across different commodities to reduce risk exposure.

- Risk Management Strategies: Set stop-loss orders and implement position sizing to manage potential losses.

- Stay Informed: Stay updated on market trends, geopolitical events, and economic indicators influencing commodities prices.

- Yes, many brokers offer margin trading for indices. Trading on margin allows you to control a larger position size with a smaller amount of capital. However, it also amplifies both potential gains and losses, so it’s important to use margin responsibly.