Let’s navigate the Forex market together

Forex Trading with Seamless Markets

Also known as Foreign Exchange, currency trading or FX is a global market for trading one currency for another one from a different country.

What is Forex Trading

Forex, short for foreign exchange, is the decentralized global marketplace where currencies are traded. It is the largest and most liquid financial market globally, where participants engage in the exchange of one currency for another. At Seamless Markets, we provide a comprehensive platform for you to navigate the intricate world of forex trading.

In the dynamic world of forex trading, Seamless Markets stands as your gateway to limitless opportunities. With access to a vast range of currency pairs, you can trade major, minor, and exotic currencies with ease. Our platform is designed to cater to traders of all levels, from beginners to seasoned professionals.

Why Trade Forex with Seamless Markets? Unleash Your Trading Potential

Embark on a transformative journey into the world of forex trading with Seamless Markets. As your dedicated partner in financial success, we offer a multitude of reasons why choosing us as your forex trading provider can make a significant difference in your trading experience.

Getting Started with Forex Trading

Join us today, and let’s navigate the Forex market together, unlocking opportunities and realizing your trading potential Follow these simple steps to get started:

Open an Account

Choose the account type that suits your trading style and open an account with Seamless Markets.

Deposit Funds

Fund your account using our secure and convenient funding options

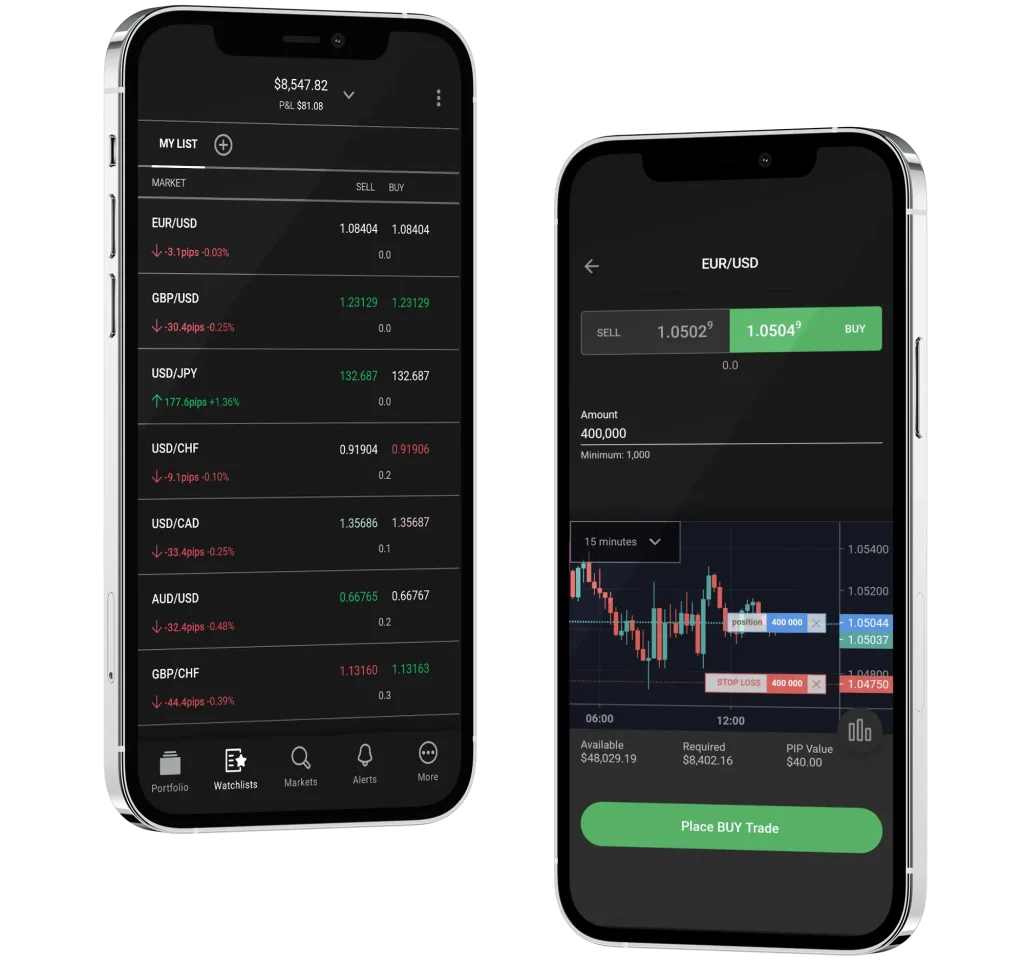

Choose Your Platform

Select the trading platform that aligns with your preferences – be it the robust the advanced MT5.

Start Trading

Explore the Forex market, execute your trades, and experience the excitement of Forex trading with Seamless Markets.

Forex Explained

Navigating the World’s Largest Financial Market Forex, or the foreign exchange market, stands as the largest and most liquid financial market globally. It serves as the primary platform where currencies are traded. Understanding the basics of forex is crucial for anyone venturing into the dynamic world of currency trading.

In forex trading, currencies are traded in pairs. Each currency pair consists of two currencies, with one being bought and the other being sold. Major pairs involve the most widely traded currencies, such as the Euro (EUR), US Dollar (USD), Japanese Yen (JPY), and British Pound (GBP).

Exchange rates represent the value of one currency in terms of another. These rates are influenced by various factors, including economic indicators, geopolitical events, and market sentiment.

The bid price refers to the maximum price a buyer is willing to pay for a currency pair, while the ask price is the minimum price a seller is willing to accept. The difference between these prices is known as the spread.

Forex trading often involves the use of leverage, allowing traders to control larger positions with a relatively small amount of capital. While leverage can amplify profits, it also increases the risk of losses.

The forex market comprises various participants, including central banks, financial institutions, corporations, and individual traders. The decentralized nature of forex ensures continuous trading 24 hours a day, five days a week.

Frequently Asked. Questions

Forex is traded via a global network of banks in what’s known as an over-the-counter market – unlike stocks and commodities, which are bought and sold on exchanges. Because of this, you can trade forex 24 hours a day during market hours.

FX trading is split across four main ‘hubs’ in London, Tokyo, New York and Sydney. When banks in one of these areas close, those in another open, which is what facilitates round-the-clock trading.

However, there’s no physical location where these banks and individuals trade with each other. Instead, it is entirely online.

People trade currencies for lots of different reasons. You’ve probably traded a currency if you’ve ever bought goods overseas, for example, or gone on a vacation in another country. However, the vast majority of FX trading is done for profit.

Currencies are constantly moving in value against each other. On any given day, the pound might be rising against the dollar, while the euro falls against the Swiss franc. Forex traders buy and sell currency pairs to try and take advantage of this volatility and earn a return.

For instance, if the pound is rising against the dollar, you might buy GBP/USD. When you buy this pair, you’re buying pound sterling (GBP) by selling the US dollar (USD). Then, if the pound continues to outpace the dollar, you can sell the pair to exchange your GBP back for USD and keep the difference as profit.

The forex market is open for trading 24 hours a day from 9 PM UTC on Sunday to 9 PM UTC on Friday. That means with FX, you can build your trading strategy around your schedule, instead of having to conform to when a stock exchange is open.

However, there are times when the market is much more active, and times when it is comparatively dormant.

At Seamless Markets you can trade CFDs across Forex, Shares, Metals, Indices, Commodities & Cryptocurrencies. We offer 10,000+ tradable CFD products across global financial markets. Simply choose your desired trading platform and begin a seamless trading experience.