Let’s navigate the Indices Trading together

Indices Trading with Seamless Markets

Indices trading, often referred to as trading stock market indices, involves speculating on the performance of a collection of stocks representing a particular market or sector. These indices serve as indicators of the overall health and direction of the financial markets, offering traders diverse opportunities for investment and hedging strategies.

What is Shares Trading

Stock market indices give the measure of a specific stock market. They represent the value of a group of stocks from a country, and represents the overall, current and historic performance of a specific set of stocks. The calculated value of the stock index is used by investors as an indicator of the current value of their component stocks. Investors can find out the expected returns over time by comparing the current and historic index levels.

Indices trading offers a versatile and efficient way for traders to engage with the financial markets, leveraging the performance of entire sectors or economies. Like any form of trading, it requires careful analysis, risk management, and a strategic approach to navigate the dynamic landscape of index markets.

Unlocking Opportunities with Index Trading Understanding the Benefits

Broad Market Exposure

- Diversification: Index trading provides exposure to a basket of stocks, allowing investors to spread risk across various sectors and companies.

- Market Representation: Indices, like the S&P 500 or NASDAQ, represent the broader market, offering a snapshot of its overall health and direction.

Liquidity and Transparency

- Market Liquidity: Major indices are highly liquid, facilitating easy buying and selling of index-related instruments.

- Transparent Pricing: The transparent nature of indices ensures that investors have access to real-time pricing information.

Efficient Portfolio Management

- Single Investment: Through index trading, investors can gain exposure to an entire market or sector with a single investment, reducing the need for individually selecting and managing multiple stocks.

- Time Efficiency: Index trading is time-efficient as it eliminates the need for extensive research on individual companies. Investors can track the performance of a broader market instead.

Benchmarking and Performance Measurement

- Benchmark Comparisons: Indices serve as benchmarks for measuring the performance of investment portfolios. Investors can assess how well their portfolio is performing relative to the broader market.

- Investment Evaluation: Tracking indices helps in evaluating the success of investment strategies and making informed decisions based on market trends.

Flexibility in Trading Strategies

- Long and Short Positions: Traders can take advantage of both bullish and bearish market conditions. They can go long (buy) if they anticipate a rise in the index value or go short (sell) to profit from a decline.

Flexibility in Trading Strategies

- Long and Short Positions: Traders can take advantage of both bullish and bearish market conditions. They can go long (buy) if they anticipate a rise in the index value or go short (sell) to profit from a decline.

Why Trade Indices with Seamless Markets? Unleash Your Trading Potential

Index trading, a popular form of financial market participation, offers traders and investors a range of advantages, making it a compelling option for those seeking diversified exposure and strategic portfolio management.

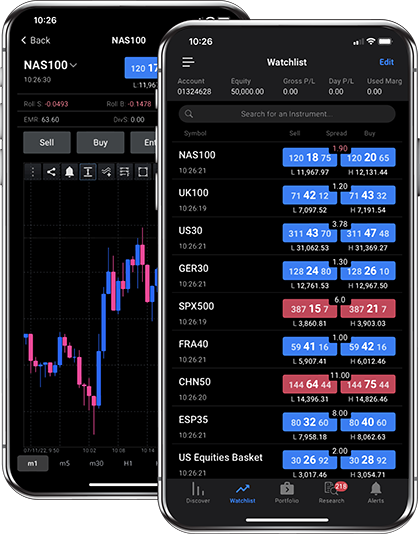

Getting Started with Indices Trading

Ready to explore the world of indices trading? Follow these steps to begin your journey with Seamless Markets, Join Seamless Markets today and unlock the potential of global indices trading.

Open an Account

Choose the account type that suits your trading style and open an account with Seamless Markets.

Deposit Funds

Fund your account using our secure and convenient funding options

Choose Your Platform

Select the trading platform that aligns with your preferences.

Start Trading

Dive into the world of indices trading, analyze market trends, and execute your trades with confidence.

Indices Explained

Indices, often referred to as indexes, play a pivotal role in the financial markets, serving as barometers of overall market health and providing valuable insights for traders and investors. Let’s delve into what indices are, how they work, and their significance in the world of finance.

Key Components of Indices:

- Market Capitalization: Many indices use market capitalization as a criterion, giving more weight to larger companies.

- Price-Weighted or Equal-Weighted: Indices may be price-weighted (based on stock prices) or equal-weighted, where each constituent has an equal influence.

- Sector Representation: Indices often include companies from various sectors to ensure diversification.

- Geographical Spread: Global indices may consist of companies from different countries, providing geographical diversification.

- Capitalization-Weighted: The most common method, where the weight of each component is proportional to its market capitalization.

- Price-Weighted: The index value is influenced by the stock prices of its components.

- Equal-Weighted: Each constituent has the same weight, irrespective of its market cap or stock price.

Frequently Asked. Questions

To trade indices, you can use various financial instruments:

- Index Futures: Contracts that obligate the buyer to purchase or the seller to sell the index at a predetermined future date.

- Index Options: Contracts that give the holder the right, but not the obligation, to buy or sell the index at a specific price before or at expiry.

- Contracts for Difference (CFDs): Derivative products allowing traders to speculate on index price movements without owning the underlying assets.

Several factors impact index prices:

- Economic Indicators: Economic data, such as GDP, employment figures, and inflation rates, can influence investor sentiment.

- Corporate Earnings: Strong or weak earnings reports from index constituents can drive market movements.

- Central Bank Policies: Decisions on interest rates and monetary policies can affect market dynamics.

- Geopolitical Events: Political instability or global events may impact market sentiment and index values.

Indices trading offers several advantages:

- Diversification: Gain exposure to a broad market or sector with a single trade.

- Liquidity: Major indices are highly liquid, allowing for easy entry and exit.

- Risk Management: Use risk management tools like stop-loss orders to control potential losses.

- Speculative Opportunities: Capitalize on both rising (long) and falling (short) markets.

- Yes, many brokers offer margin trading for indices. Trading on margin allows you to control a larger position size with a smaller amount of capital. However, it also amplifies both potential gains and losses, so it’s important to use margin responsibly.