Let’s navigate the Shares Trading together

Shares Trading with Seamless Markets

Shares trading, also known as stock trading, involves the buying and selling of ownership in publicly-listed companies. Investors purchase shares, which represent a portion of the company’s ownership, with the aim of profiting from changes in the stock’s price.

What is Shares Trading

Shares trading, also known as stock trading, involves the buying and selling of ownership in publicly-listed companies. Investors purchase shares, which represent a portion of the company’s ownership, with the aim of profiting from changes in the stock’s price.

Explore global stock markets and trade shares with confidence at Seamless Markets. As a leading brokerage firm, we provide you with access to a wide range of shares, allowing you to build a diversified and dynamic investment portfolio.

Understanding the Difference Between CFD Trading and Share Trading

CFD Trading

Contract for Difference (CFD) trading is a financial derivative that allows traders to speculate on price movements in various financial markets without owning the underlying asset. Here’s how CFD trading works:

No Ownership: CFD traders do not own the actual asset (e.g., shares, commodities, or indices) but enter into a contract with the broker to exchange the difference in the asset’s value between the opening and closing of the trade.

Leverage: CFDs often involve the use of leverage, allowing traders to control a larger position with a smaller amount of capital. While leverage can amplify profits, it also increases the risk of significant losses.

Short Selling: Traders can profit from both rising and falling markets by either going long (buying) or short (selling) CFDs. This flexibility is advantageous in various market conditions.

Global Market Access: CFDs offer exposure to a wide range of markets, including stocks, indices, commodities, and currencies, providing traders with diversified trading opportunities.

Share Trading

Share trading, on the other hand, involves buying and owning the actual shares of a company. Here are the key aspects of share trading:

Ownership: When you buy shares, you become a shareholder and own a portion of the company. Shareholders may be entitled to dividends and have voting rights at company meetings.

Long-Term Investment: Share trading is often considered a form of long-term investment. Investors aim to benefit from capital appreciation over time and may receive dividends as a share of the company’s profits.

No Leverage: Unlike CFDs, traditional share trading typically does not involve leverage. Investors use their own capital to buy shares and do not borrow funds to amplify their positions.

Limited Market Hours: Share markets usually operate during specific hours, and trading is limited to these hours. In contrast, CFD markets often allow trading 24/5, reflecting global market hours.

Why Trade Shares with Seamless Markets? Unleash Your Trading Potential

Trading metals with Seamless Markets opens a realm of possibilities for investors seeking to diversify their portfolios and explore the lucrative world of precious metals. As a leading brokerage, we offer a distinctive set of advantages that make metals trading with us a rewarding experience.

Getting Started with Shares Trading

Ready to explore the world of shares trading? Follow these steps to begin your journey with Seamless Markets:

Open an Account

Choose the account type that suits your trading style and open an account with Seamless Markets.

Deposit Funds

Fund your account using our secure and convenient funding options

Choose Your Platform

Select the trading platform that aligns with your preferences.

Start Trading

Dive into the world of shares trading, analyze market trends, and execute your trades with confidence.

Shares Explained

Unleashing Opportunities

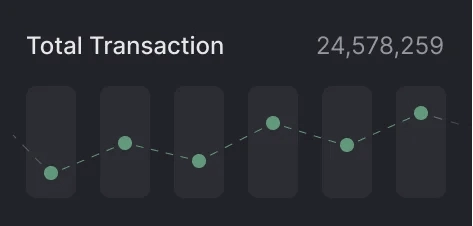

Shares trading is a dynamic and integral aspect of financial markets, providing investors with a gateway to participate in the success of publicly listed companies. Also known as stocks or equities, shares represent ownership in a company and confer various rights and benefits to the shareholders.

Shares trading provides opportunities for capital appreciation, income generation, and portfolio diversification. However, it’s essential for investors to stay informed, continually assess their investment strategy, and adapt to changing market conditions. Seeking advice from financial professionals can further enhance one’s understanding and success in the shares market.

Key Elements of Shares Trading:

- When an investor buys shares, they become a partial owner of the company. Shareholders have a claim on the company’s assets and are entitled to a portion of its earnings.

- Companies may distribute a part of their profits to shareholders in the form of dividends. This can be a lucrative source of income for investors.

- Shares are traded on stock exchanges, where buyers and sellers come together. Major stock exchanges include the New York Stock Exchange (NYSE), NASDAQ, and others.

- Investors can participate in the market by buying shares with the expectation that their value will increase over time.

- Common Shares: These confer voting rights at shareholder meetings and the potential for dividends. However, common shareholders are the last to receive company assets in case of liquidation.

- Preferred Shares: Preferred shareholders enjoy priority in receiving dividends and assets but usually do not have voting rights.

Frequently Asked. Questions

Share CFD trading involves the use of Contracts for Difference (CFDs) to speculate on the price movements of shares without owning the actual shares. Traders enter into a contract with the broker, and the difference in the share’s value is exchanged between the opening and closing of the trade.

Share CFD trading allows traders to go long (buy) or short (sell) on the price movements of shares. Leverage is often employed, enabling traders to control larger positions with a smaller amount of capital. Profits or losses are determined by the difference between the entry and exit prices.

- Leverage: Share CFDs often involve the use of leverage, allowing traders to amplify their exposure to price movements.

- Diversification: Traders can access a wide range of shares and industries, creating a diversified portfolio.

- Short Selling: Share CFDs enable traders to profit from both rising and falling markets.

- Leverage Risk: While leverage can amplify profits, it also increases the risk of significant losses.

- Market Risk: Share prices can be influenced by various factors, including economic conditions, company performance, and market sentiment.